Debt, the word alone carries a weight of responsibility. It creates a sense of obligation, with some level of anxiety. Perhaps my personal experiences shape my perception. As a teenager, I once borrowed money from a friend to go to the cinema, having exhausted my monthly (state-supported) income of 80 EUR. When I told my father, he was furious. He told me to repay my friend (he borrowed me money) and sternly instructed me never to borrow from anyone but him. I kept that promise until I was 21 years old and about to attend university. Even then, despite Sweden’s low-interest student loans (below 2%) and nearly 20% of the population having them, the thought of debt triggered anxiety, leaving me in tears as I applied.

Yet, as a millennial, I have seen debt framed differently too, particularly in the context of homeownership. Taking out a mortgage has often been seen as a smart financial move, a pathway to security and investment. However, this notion is largely based on the financial conditions (housing politics in the last decades in Sweden) that baby boomers enjoyed rather than the reality for younger generations today. The fundamental truth remains: debt must be repaid. That is its defining characteristic. This is why it is so intriguing to examine our economic system, where debt is vast and seemingly perpetual. Debt exists because there is confidence in the future, in the belief of growth, and in the ability to repay. But how does this function in practice?

The Global Debt Landscape

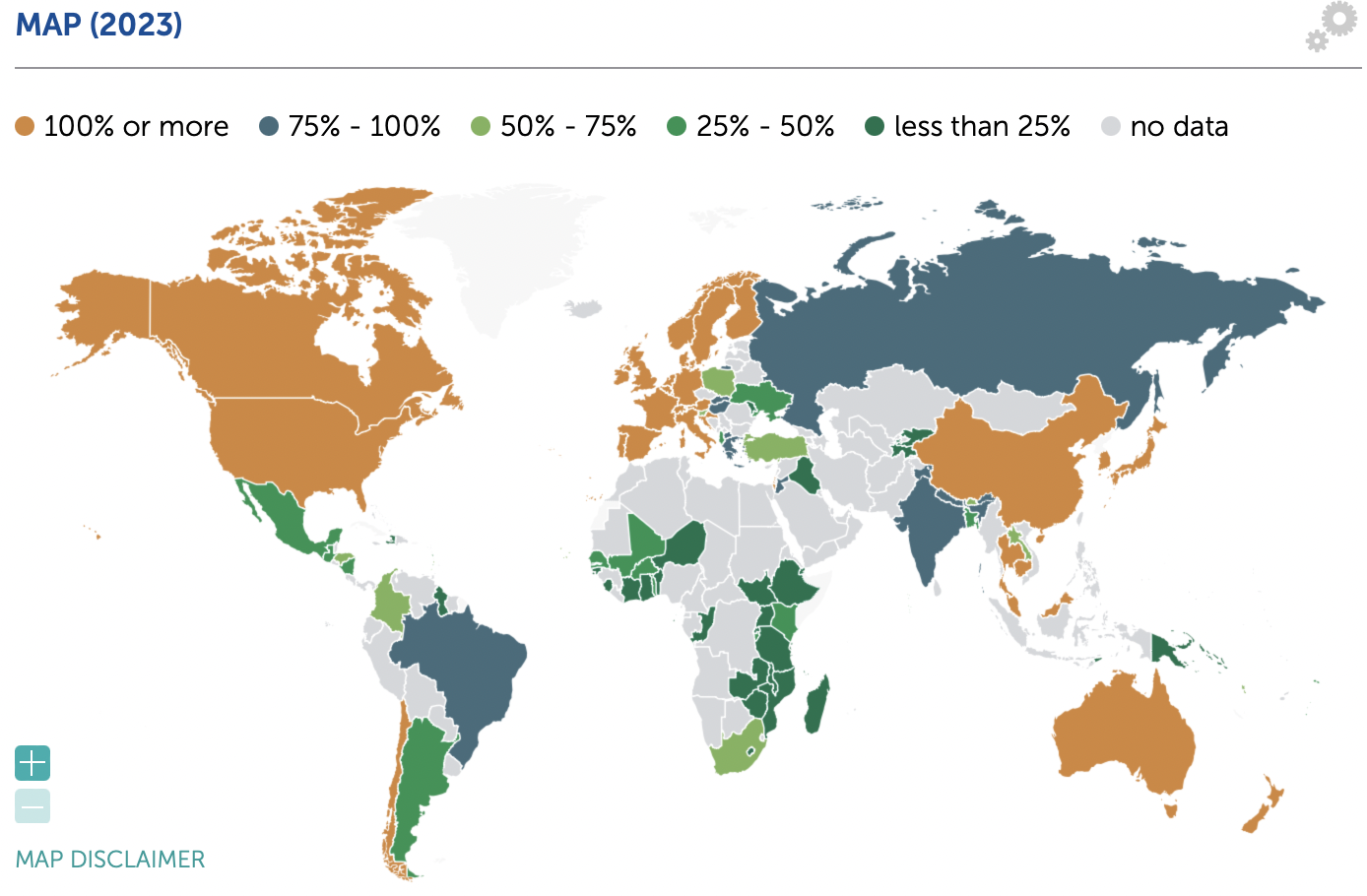

According to the International Monetary Fund (IMF), global debt reached $250 trillion in 2023, equating to 237% of global GDP. While private debt decreased, public debt rose to $98 trillion. Notably, private debt in the United States dropped by six percentage points, whereas in China, it surged by 6.5 percentage points. And as you can see in the graphs below, public debts are increasing when there’s a financial or other kinds of crisis (such as the pandemic).

It is staggering to consider that global debt is 2.4 times larger than the global GDP. However, debt is an essential element of modern economies. Have you ever seen a high-income country without debt? Likely not, because borrowing is a tool for future investments, intended to boost economic growth. While some argue that higher public debt stifles economic expansion, research suggests the relationship is more nuanced. The impact depends on how debt is structured and measured. For instance, a low state debt can look good, but won’t give the whole picture if your’re not looking at the total debt of the economy, where in Sweden municipality and regional debts have increased. Further, if more of the public services are run by private companies, the debt ratio won’t give a fair picture either. Based on a study from Lund, developed economies increase in GDP growth should however lower public debt (but I lack the real-life examples to confirm such a transition).

A critical question remains: at what point does debt become a drag on economic growth? Studies indicate that once a country’s public debt surpasses 77% of GDP, it starts reducing annual real GDP growth by 0.017%. If this threshold holds true, what does it mean for a global economy with a 237% debt-to-GDP ratio?

Private debt, loans and debt securities

Private debt, loans and debt securities

Central Government Debt

Central Government Debt

Household debt, loans and debt securities

Sweden’s Debt Structure and Economic Stability

Sweden has long maintained a strict fiscal framework to ensure low state debt. Since the mid-1990s, the government has adhered to policies designed to control public debt. A debt anchor, set at 35% of GDP, was introduced to provide a benchmark for sustainable borrowing. However, measuring Sweden’s debt should be done with some nuances (points made by Daniel Waldenström at Ekonomists) :

Which debt matters?

The national debt (central government) was 1,280 billion SEK in 2020.

The Maastricht debt (total public sector) stood at 1,974 billion SEK, approximately 50% higher.

As municipalities and regions are financially intertwined with the state, focusing solely on national debt can be misleading.

Public assets and net position

Sweden’s government holds significant financial assets, including pension funds, infrastructure, and reserves.

The overall net financial position remains positive, largely thanks to pension fund surpluses since the 1960s.

Debt-to-GDP vs. Net National Product (NNP)

GDP is the conventional metric for debt comparison, but NNP, which adjusts for capital depreciation, may provide a clearer picture.

In 2020, Sweden’s public debt was 26% of GDP, but 48.2% of NNP, revealing a more substantial burden than GDP-based metrics suggest.

Interest rates and borrowing costs

Interest payments on national debt have fallen from 4% of GDP in 2000 to below 0.5% in 2020, thanks to lower borrowing costs and fiscal discipline.

However, rising interest rates could challenge Sweden’s ability to maintain such low costs in the future.

Debt risk in crises

Sweden’s government debt surged during economic crises in the 1990s and 2008.

A future financial crisis could push Sweden’s Maastricht debt to 80-90% of NNP, an unprecedented level.

In other words, Sweden might look good compared to other economies when just looking at the state debt, but if you include the regions and the municipalities or the household debts as in the graphs above, it’s a different story.

The Debt Trap in Developing Nations

While high-income countries manage their debt through several mechanisms (such as a growing economy, low interest rates, privatisation, cut of expanses, issuing new bonds etc), developing nations face a harsher reality. Public debt in these countries has soared to $29 trillion, with many still repaying loans from structural adjustment programmes, infrastructure projects, or bailout funds dating back to the 20th century. I’m not going into the colonial, modern-trade and climate aspects of this highly injustice and morally questionable situation but I want to bring up the difference in the debt data.

The real issue here is not only the debt itself but the cost of servicing it. In 2023, developing nations paid $847 billion in interest payments alone. For 54 countries, over 10% of their government revenues go towards debt servicing, while 48 nations spend more on debt repayments than on education or healthcare, affecting 3.3 billion people.

Moreover, in 2022, the Global South experienced a net resource outflow of $49 billion, meaning more money was paid to creditors than was received in new loans. This ongoing financial drain stifles development and limits investment in critical services. The ever-growing debt burden makes these economies vulnerable to financial crises and external shocks, locking them in a cycle of dependency. Without restructuring efforts and fairer lending terms (maybe a complete cancellation in some areas?), many developing nations will struggle to break free from this cycle.

Conclusion: Rethinking Debt in Our Economic System

Debt is an integral part of our economic system. It enables investment and is supposed to fuel economic growth. But what happens when the economy doesn’t grow that much? Or if the things that grow increase costs in other areas, which then have to be met by more loans? Debt sustainability further depends on responsible decision-making. For example, increased taxes are another way to fund investments that do not rely on future promises but seem to be an unpopular option these days (hence the dependency on economic growth when we don’t want to pay for the needed investments/costs today).

Perhaps the real question is not how much debt is too much, but rather who benefits from it and at what cost. In Sweden, strategic fiscal policies have maintained stability, but not if you look at the broader picture and the global debt levels demand more attention! If the debt is a belief in the future, then we must ask ourselves if this debt is going to help us create the economic prosperity that we seek. Further, if the system itself is grounded in the other debts we’re currently facing (such as the climate crisis and possible breakdown of global food systems, for example?). What are we truly investing in? And when are we expected to harvest the promises of that better world we’re putting ourselves in deep debt over?

Sources:

IMF database